New tax year 2024/25 rates:

- Personal allowance remains £12,570 - Tax Code 1257L

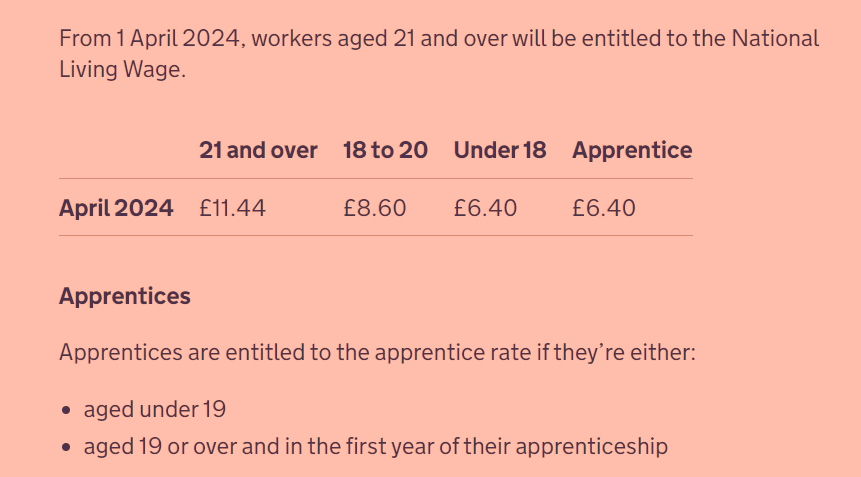

- National Living Wage now includes workers over 21 years old (previously 23)

- Employees on a standard Catagory A national insurance lowered from 10% to 8% on annual earnings between £12,570 and £50,270

- Employers national insurance remains 13.8%

The current HMRC checklist for new starters to use can be downloaded |